Kenya Revenue Authority (KRA) has on boarded over 500 fuel stations onto the Electronic Tax Invoice Management System (eTIMS) fuel module which represent approximately 16 percent of fuel stations nationwide following its rollout in December 2025.

According to the Authority, the eTIMS Fuel Module is designed to provide end-to-end visibility of petroleum transactions, from importation through distribution to final retail sale, thereby strengthening tax compliance and ensuring equity across the petroleum value chain.

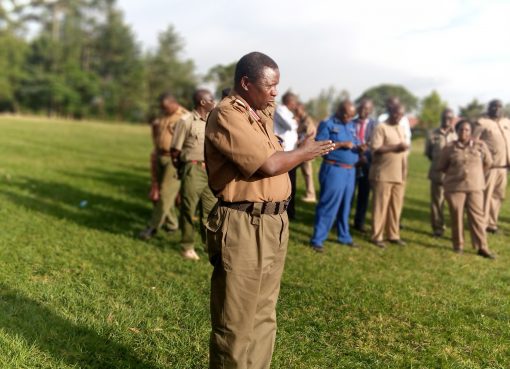

Speaking at Be Energy Ruai, in Nairobi, the KRA Acting Deputy Commissioner for Large Taxpayers’ Office, Ezekiel Obura noted that revenue collection within the sector is expected to grow by double digits following the full implementation of the module.

“The system integrates seamlessly with import records and the VAT administration framework, enabling automatic reconciliation of physical fuel volumes against declared sales volumes and corresponding tax positions,” stated Obura.

He urged the public to embrace the culture of requesting for eTIMS receipts after every fuel purchase, and encouraged fuel stations that are yet to on-board to comply, noting that KRA is ready to facilitate onboarding and engage with the sector, to cushion enforcement measures.

The Dep. Commissioner further added that all Oil Marketing Companies (OMCs) have now been domiciled at the Large Taxpayers to enable closer monitoring, faster issue resolution and tailored compliance support.

Similarly, Obura highlighted that the implementation of the eTIMS fuel station solution is undertaken in close collaboration with key stakeholders, including Energy and Petroleum Regulatory Authority (EPRA), Petroleum Institute of East Africa (PIEA), Petroleum Outlets Association of Kenya (POAK) and United Energy & Petroleum Association (UNIPEA), to ensure that regulatory, operational and industry realities are fully addressed.

Concurrently, KRA Chief Manager, eTIMS Office, Hakamba Wangwe, emphasized that the module forms part of KRA’s broader strategy to simplify tax processes through digital platforms.

“The eTIMS Fuel Stations Module is a game changer for tax compliance and transparency. It simplifies the tax process for taxpayers and enhances oversight for the Authority, supporting Kenya’s broader goal of a fully digital, efficient and accountable tax system,” Wangwe explained.

She added that fuel is a controlled commodity with regulated pricing and structured supply chains, and through the module, KRA is leveraging data integration such as import data and pricing benchmarks from EPRA to enhance oversight across the sector, enabling assessment of expected revenues across the fuel value chain.

“This innovation enhances visibility of fuel movements, from importation and storage to transfers between operators and retail sales at service stations, supporting more accurate reporting, minimizing revenue leakage, and strengthening compliance across the sector,” said Wangwe.

Speaking on behalf of Be Energy Ruai, Josephine Warui noted that sales summaries are now automatically generated and receipts seamlessly discharged within the system, significantly reducing customer service time.

“Our reports are quite easy and we use less time to serve our customers, you fuel and your receipt is instant,” mentioned Warui.

Prior to the rollout, KRA piloted the module with volunteer fuel stations between September and December 2024 to test technical integration, gather operational feedback and strengthen compliance frameworks ahead of full-scale implementation.

Nationwide on boarding commenced in January 2025. Although the initial onboarding deadline was 30th June 2025, stakeholders requested additional time to comply, prompting KRA to extend the deadline to December 2025.

Under the new system, eTIMS receipts are issued instantly at the point of sale upon request and can be generated for both individual motorists and businesses.

KRA continues to collaborate with stakeholders across the sector to facilitate onboarding and ensure compliance with the Value Added Tax (Electronic Tax Invoice) Regulations, 2020. KRA also encourages consumers to request an eTIMS receipt with every fuel purchase.

By Michael Omondi