More than Sh106 billion in dormant financial assets could be injected directly into Kenya’s household economy if fully claimed.

This would provide a significant liquidity boost capable of stimulating consumption, savings and micro-level investment under the government’s Bottom-Up Economic Transformation Agenda (BETA).

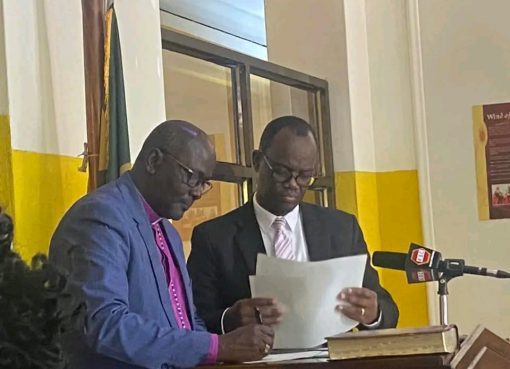

The potential economic impact was highlighted during the second day of an Unclaimed Financial Assets Authority (UFAA) reunification clinic at Uhuru Gardens in Kericho town.

The authority outlined how unclaimed financial assets are being repositioned from idle balances into productive household capital.

In an interview with the Kenya News Agency, UFAA Chairman Dr. Francis Kigo Njenga said unclaimed financial assets represent locked private wealth that, once returned to owners, can support grassroots economic activity without recourse to additional public borrowing or fiscal expansion.

“We are mandated to ensure that the Sh106.6 billion in unclaimed financial assets gets back into the pockets of Kenyans to stimulate the economy, because once this money is claimed, it directly supports the Bottom-Up Economic Transformation Agenda,” Dr. Njenga said.

He noted that unlike conventional stimulus measures, reunification of unclaimed assets places purchasing power directly in the hands of citizens, strengthening household balance sheets and supporting demand-driven economic recovery.

Dr. Njenga explained that UFAA is a State corporation operating under the National Treasury, established through the Unclaimed Financial Assets Act, 2011, with a statutory mandate to receive, safeguard and reunify unclaimed financial assets with their rightful owners.

Such assets include dormant bank accounts, uncollected dividends, shares, fixed deposits, unpresented banker’s cheques, insurance proceeds and mobile money balances that remain unclaimed after a statutory dormancy period of between two and five years.

“The law is clear that no institution or individual should hold money whose owner cannot be traced, and once such assets remain unclaimed within the prescribed period, they must be surrendered to the Authority,” Dr. Njenga said.

He added that asset holders required to comply include commercial banks, telecommunication companies, listed firms, registrars, insurance companies and other financial institutions, warning that failure to remit unclaimed assets constitutes an offence under the law.

On asset protection, Dr. Njenga said UFAA safeguards cash balances by placing them with the Central Bank of Kenya (CBK) and through approved government securities, ensuring security, transparency and preservation of value while minimising exposure to misuse or abuse.

Currently, the Authority holds Sh40.6 billion in cash under the Central Bank of Kenya and Sh66 billion worth of shares under secure custodial arrangements with licensed registrars, reflecting the scale of dormant capital within the financial system.

Beyond custody, he emphasised that reunification remains UFAA’s most critical function, noting that the Authority has invested heavily in decentralised and technology-enabled systems to lower access barriers and transaction costs for citizens.

“This money does not belong to the dead; the majority of it belongs to living Kenyans across all generations, from Gen Z to baby boomers, and our work is simply to reunite citizens with their money,” he said.

Residents of Kericho County and the wider South Rift region were called upon to turn up in large numbers at the ongoing reunification clinic and take advantage of the on-site verification and claims support being offered by UFAA officers.

Kenyans can verify and lodge claims through the *361# USSD platform, Huduma Centres, chiefs and assistant chiefs, Deputy County Commissioners, Assistant County Commissioners and other national government administrative offices across the country.

The Kericho clinic forms part of UFAA’s nationwide decentralisation programme aimed at expanding public awareness, strengthening confidence in the financial system and unlocking idle household capital to support consumption, savings and small-scale investment at the grassroots level.

Officials said sustained reunification of unclaimed assets is expected to contribute to improved household resilience, deeper financial inclusion and broader participation in Kenya’s economic recovery and long-term growth trajectory.

By Gilbert Mutai