The 2025 Annual General Meeting and Conference of the International Association of Deposit Insurers – Africa Regional Committee (IADI-ARC), was held in Mombasa Kenya, with a rallying call that Deposit Insurance Systems must evolve in tandem with the challenges of modern finance.

With the theme “Enhanced Bank Resolution Frameworks and the Vital Role of Deposit Insurance Systems in Bank Failure,” the event brought together over 100 delegates from across Africa, Asia, the Americas, and Europe.

The discussions were timely, as global financial systems continue to grapple with increasing complexity, heightened interconnectedness, and rising systemic risks.

Speed, transparency, cross-agency coordination, and public awareness were also highlighted as key components of effective bank resolution.

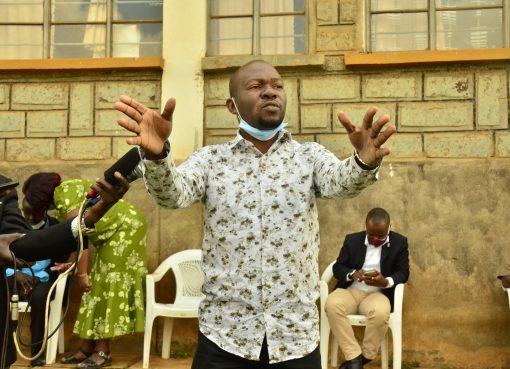

Presiding over the conference, Principal Secretary for the State Department of National Treasury and Economic Planning Mr Cyrell Odede emphasized that a resilient financial system is foundational to public trust, economic stability, and national progress.

He highlighted the government of Kenya’s steadfast commitment to reinforcing financial stability through policies that protect depositors—especially during periods of economic uncertainty.

He noted that maintaining the health of the financial sector is a collective effort involving both fiscal and monetary authorities and stressed that deposit insurance systems are not reactive tools, but proactive guarantees—a critical component of financial safety nets that preserve confidence even in times of institutional failure.

“It is here that deposit insurance systems play a transformative role,” PS Odede stated. “When a bank fails, deposit protection ensures that public confidence does not collapse alongside it.”

At the center of this effort in Kenya is the Kenya Deposit Insurance Corporation (KDIC), which was widely lauded for its leadership, technical capability, and ethical foundation.

He praised KDIC for its achievements, including: Growth of the Deposit Insurance Fund from Sh105 billion in 2019 to Sh260 billion in 2025, introduction of a risk-based premium assessment model in 2022 to incentivize sound risk management, deployment of advanced technologies like the Enterprise Data Warehouse (EDW), and the ongoing payments to depositors and creditors of failed banks such as Pan African Bank, Euro Bank, Chase Bank, and Kenya Finance Bank.

The Principal Secretary affirmed that the Ministry remains fully committed to supporting KDIC’s mandate and to fostering regional and international collaboration for stronger financial systems.

Speaking on behalf of KDIC, Board Chairperson Mrs. Hannah Muriithi, EBS, emphasized that the Corporation’s mandate goes beyond mere compensation but encompasses promoting sound risk management, timely intervention, and the resolution of troubled institutions.

She highlighted the KDIC Board’s efforts to align operations with international best practices, particularly the IADI Core Principles.

She also pointed out that KDIC had significantly strengthened its early warning systems, legal frameworks, and internal governance to ensure agility and operational readiness in the face of financial distress.

“Resolution planning is a continuous process embedded in sound institutional governance,” Mrs. Muriithi said. “A well-governed, well-resourced, and independent deposit insurer contributes decisively to the stability of the financial sector.”

Mrs. Hellen Chepkwony, KDIC’s Chief Executive Officer and Deputy Secretary General of the IADI Africa Regional Committee, reiterated the Corporation’s mission of being a proactive risk minimizer.

She outlined KDIC’s threefold mandate in providing a deposit insurance scheme for customers of member institutions, offering incentives for sound risk management, and promptly resolving problem banks to mitigate failures early.

Mrs. Chepkwony acknowledged the social and psychological toll that bank failures have on ordinary citizens, reinforcing that deposit insurers are the last line of defense against loss of trust and financial despair.

KDIC’s preparedness was underlined as a top priority, supported by technology, capacity building, and strong national collaboration.

She also touched on the importance of cross-border cooperation, noting that deposit insurance cannot work in isolation.

“How do we ensure speed in intervention? How do we uphold market discipline while maintaining trust?” She posed these questions that formed the foundation of several conference deliberations.

IADI-ARC Chairperson Dr. Julia Clare Olima Oyet commended KDIC for its professionalism in organizing the conference noting that the concept of deposit insurance took root in Kenya before spreading across the continent—a reminder of Kenya’s pioneering role in financial reforms.

Dr. Oyet described how the complexity and interconnectedness of modern financial systems increase the urgency for sound supervisory and resolution mechanisms.

She warned that even isolated bank failures can trigger systemic risk and undermine public trust.

“Deposit Insurance Systems and robust resolution frameworks must be viewed as indispensable pillars of financial safety nets. A well-designed scheme not only protects depositors but also supports orderly resolution and limits moral hazard,” said Dr Oyet.

She applauded institutions such as the Nigeria Deposit Insurance Corporation (NDIC) and the Deposit Protection Fund of Uganda (DPF) for successfully making payouts to depositors within three days of bank closures in 2024—a major achievement in line with IADI’s Core Principles.

Dr Oyet announced the inclusion of a new member—the Deposit Guarantee Fund in Central Africa (FOGADAC), which covers six countries: Cameroon, CAR, Chad, Republic of Congo, Equatorial Guinea, and Gabon. This, she said, reflects ARC’s strategic efforts to spread sound deposit insurance practices across the region.

The Chair also highlighted two important initiatives; The launch of a Communications Technical Committee, which produced ARC’s first digital newsletter, and formation of a Research Technical Committee, currently preparing its first regional research paper.

Despite these advancements, she added, only 27 out of Africa’s 54 countries are IADI members.

“In this regard, ARC, in collaboration with the African Association of Central Banks (AACB), is working to close this gap by advocating for the establishment of deposit insurance systems across the continent,” said Dr Oyet.

The 2025 conference served as a powerful platform for reflection, collaboration, and innovation.

It underscored the centrality of deposit insurance systems in maintaining financial stability and public trust.

Through stronger legal mandates, early detection tools, regional cooperation, and strategic reforms, African nations and their global partners are taking bold steps to safeguard their banking sectors.

The event concluded with a shared commitment: to continue building robust, credible, and responsive deposit insurance frameworks that can endure uncertainty and shield depositors from financial harm.

By Dickson Mwiti