Smallholder tea farmers are set for major financial relief following the launch of Jipange Cash Advance, a new digital loan facility by DigiFarm, Safaricom’s flagship Agritech platform, in partnership with Access Bank. The product, unveiled at Sunshine Upper Hill Hotel in Kericho, is designed to help farmers access instant cash based on monthly tea deliveries, bridging the long-standing cashflow gap between leaf delivery and final factory payments.

The initiative comes amid growing concerns about farmer vulnerability caused by delayed payouts, despite tea sustaining nearly one million growers nationwide and contributing more than Sh200 billion annually to the Kenyan economy. According to the Tea Board of Kenya, these delays continue to limit household welfare, stall farm investments, and weaken rural financial stability.

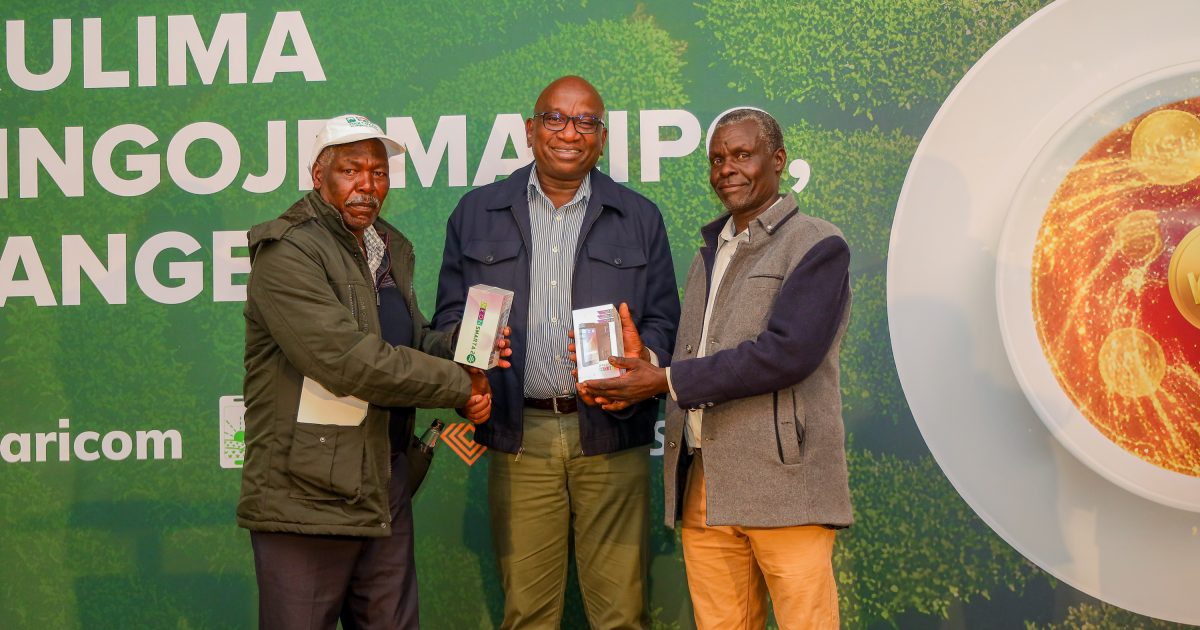

Safaricom CEO Peter Ndegwa in a press statement said the new solution responds directly to the economic strain facing smallholder farmers.

“Our farmers work tirelessly every day, yet many still struggle to make ends meet because of delayed payments. Jipange Cash Advance will provide greater peace of mind, ensuring farmers can put food on the table, pay school fees, and plan for their families,” Ndegwa said.

“As Safaricom, we are proud to stand with farmers, because when our farmers thrive, our communities and country thrive too,” he added.

The facility allows farmers to access advances through M-PESA, with repayment automatically deducted from their factory pay, removing the need for collateral while maintaining a transparent, secure repayment structure. Already, the pilot phase across four factories in the Rift Valley has recorded strong results, with DigiFarm now planning to roll out the product nationwide and expand it to dairy farmers.

In an interview with Kenya News Agency (KNA), Safaricom’s Chief Business Development and Strategy Officer Michael Mutiga said the product fills a critical financial gap that farmers have grappled with for decades.

“We saw the gap for farmers, the time difference between when they produce from the field and when they get cash from the market. Their daily needs do not stop, so Jipange bridges that reality,” Mutiga said.

He added that the pilot, involving 850 farmers with disbursements of about KES 4.7 million, had achieved nearly 100 percent repayment, signaling strong trustworthiness and reduced default risk in agriculture-linked lending.

“As we scale this to more farmers and more value chains, we are encouraged by the excellent performance and the prospect of deepening technology-driven financial inclusion,” he said.

Mutiga further noted that DigiFarm’s wider ecosystem, ranging from digital advisory to improved input access and market linkages, is strengthening farmers’ productivity and incomes.

“We want better productivity and farmers getting better prices, supported by technology, digital records, and over time, tools like AI and predictive weather insights,” he said.

Farmers who have already benefited from DigiFarm services welcomed the cash advance, saying it has eased financial pressure at both household and farm levels.

“Before DigiFarm came, we had challenges and often lacked money when we needed it most. Now we get support on time, and this salary-style advance is helping us pay school fees and manage daily needs,” said Gideon Kipchumba, a tea farmer from Nandi County, urging continued support for long-term credit options.

“DigiFarm has helped us because if I need funds, I receive them and repay responsibly. It has reduced the burden we used to put on the government and factories,” said Jane Simotwo, a Bureti farmer whose cooperative on boarded DigiFarm in 2021, calling for broader access to longer-term loan products of up to one year.

“Sometimes you deliver tea and have nothing in your pocket. With DigiFarm you can request an advance and get money immediately. It has lifted us,” said Caroline Cheruiyot, a farmer from Kiptagich.

Access Bank Kenya officials echoed the significance of the solution, noting its alignment with ongoing financial inclusion efforts.

“This product gives farmers relief within the month. They can access up to 70 percent of what they expect from their tea deliveries, helping them meet obligations like school fees and farm input costs before payouts,” said Access Bank Head of Products and Segments, Egesa.

“We see great prospects as more farmers join the platform. With successful pilots, we look to expand into other value chains and promote food security while improving livelihoods,” he added.

DigiFarm Director Seema Gohil said the platform is committed to building a resilient, technology-led rural economy.

“Farmers can now get an advance instantly through 944#, without waiting for the end-month. We begin with tea, but the same solution will support dairy and other value chains where farmers deliver produce daily but payments delay. Our mission at Safaricom is to transform lives through innovation. DigiFarm is doing that by deepening financial inclusion and strengthening the resilience of smallholder farmers,” she said.

DigiFarm, a wholly-owned Safaricom subsidiary, currently operates across 29 counties and 11 value chains, connecting farmers to credit, digital advisory, quality inputs, smart markets, and insurance. Over 110,000 farmers have accessed loans worth more than KES 1 billion, while 117,000 farmers have been linked to markets through the platform’s smart weighing and digital payments infrastructure. Tea factories and dairy cooperatives wishing to partner with DigiFarm can reach the platform through its dedicated support channels.

by Gilbert Mutai