Kiharu MP Ndindi Nyoro has called for prudent management of Kenya’s national debt to spur economic transformation without placing an undue burden on citizens.

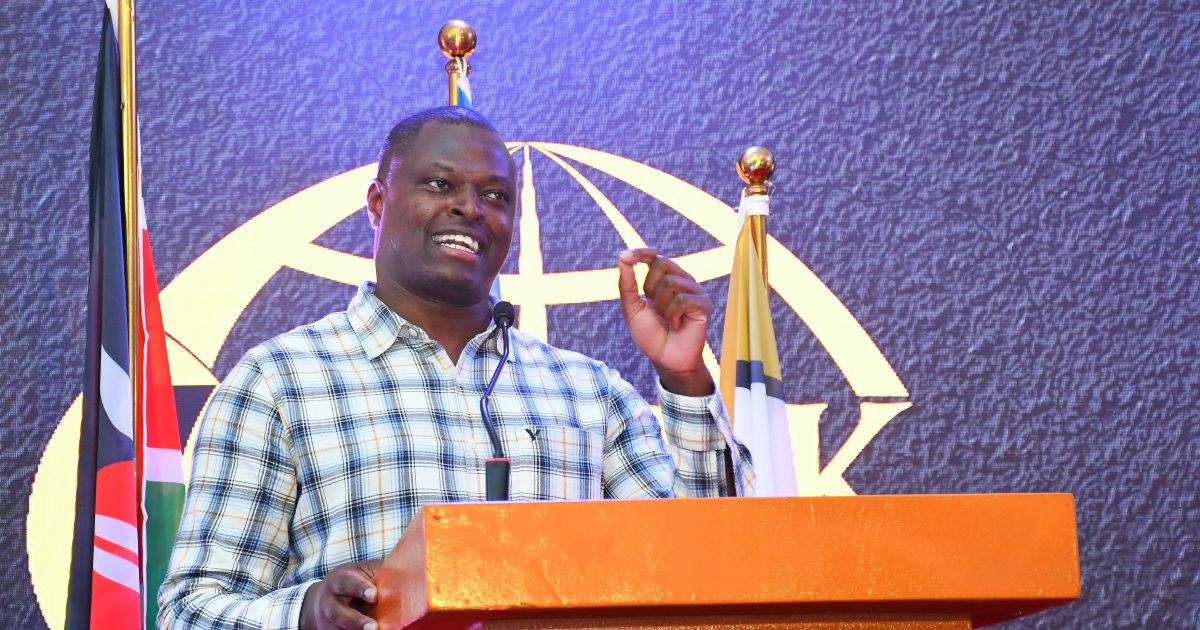

Speaking during the 42nd Annual Seminar of the Institute of Certified Public Accountants of Kenya (ICPAK) in Mombasa, themed “From Transaction to Transformation: Accountancy Impacting the World,” Nyoro cited Kiharu as a model for responsible use of public resources.

Through the National Government-Constituency Development Fund (NG-CDF), the legislator is implementing the Kiharu Masomo programme, which provides daily meals to more than 12,500-day scholars.

The initiative has also enabled fee subsidies in all public day schools, with parents now paying only Sh3,000 annually.

To enhance transparency and accountability, Nyoro urged the National Treasury and the Central Bank to maintain a single, consolidated debt register.

“Kenya must stop borrowing off the book, beyond the reported debt of Sh12.5 trillion. Kenya has already borrowed an illegal debt of Sh175 billion, where they have gone to the banks, taken a loan of Sh175 billion and then they are telling the banks they’ll be collecting the fuel levy for the next seven years,” he alleged.

He also raised concerns about the financing of the Sh45 billion Talanta Stadium in Nairobi, claiming the country secured an off-the-books loan that will be repaid through the Sports Fund over 15 years.

“The cost of the Talanta Stadium in Nairobi, the one you see on Ngong Road, is not Sh45 billion. It is the most expensive stadium in the world. It will be Sh145 billion in the next 15 years,” he purported.

Nyoro also took a swipe at the country’s fiscal and monetary policies, saying that it is addressing one issue to the detriment of the others, citing the Central Bank Rate, which is coming down, but in the private sector, it is decimated.

“It is either stagnant or going down. So, to whose interest is the interest rate in Kenya going down? It is basically because of domestic debt service.”

The MP also claimed that the exchange rate in the country is misaligned by around 12 to 18 per cent in favour of the Kenyan shilling.

“When Kenya was having its best years during President Kibaki’s time. The Kenyan shilling was actually misaligned to weaken, not to strengthen. Because when you strengthen the local currency, what are you basically doing? You make the payment of interest rate cheaper,” he argued, adding that when the shilling is misaligned, exports become less competitive.

By Sadik Hassan