The World Health Organization (WHO) has urged governments worldwide to significantly strengthen taxes on sugary drinks and alcoholic beverages, warning that weak tax systems are undermining public health efforts and straining health systems.

According to WHO, sugary drinks and alcoholic beverages are becoming increasingly affordable due to consistently low tax rates in most countries. This trend is fuelling a rise in obesity, diabetes, heart disease, cancers and injuries, particularly among children and young adults.

The call was made during the release of two new global reports: the Global Report on the Use of Alcohol Taxes, 2025 and the Global Report on the Use of Sugar-Sweetened Beverage Taxes, 2025. The reports warn that inadequate health taxes are allowing harmful products to remain cheap while governments struggle to finance responses to preventable non-communicable diseases and injuries.

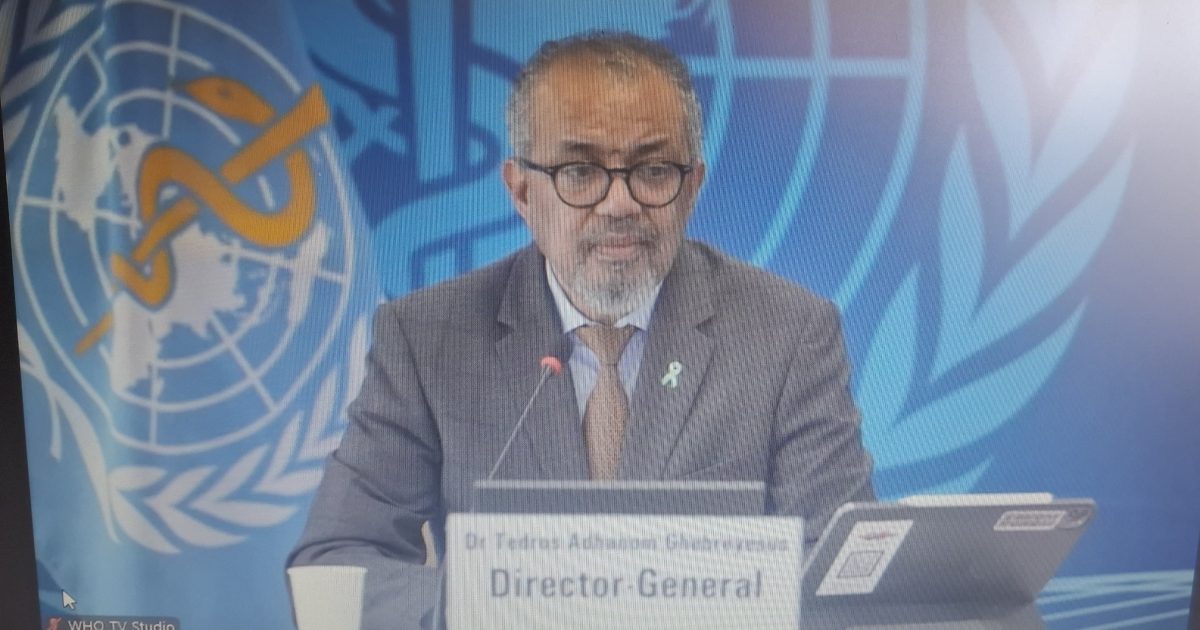

Speaking during a webinar, WHO Director-General Dr Tedros Adhanom Ghebreyesus said increasing taxes on health-harming products such as tobacco, sugary drinks and alcohol can reduce harmful consumption while generating revenue for essential health services.

“Health taxes are one of the strongest tools we have for promoting health and preventing disease,” Dr Tedros said.

WHO noted that the combined global market for sugary drinks and alcoholic beverages generates billions of dollars in profits. However, governments capture only a small share of this value through health-motivated taxes, leaving societies to shoulder the long-term health and economic costs associated with excessive consumption.

The reports show that at least 116 countries currently tax sugary drinks, most of which are carbonated soft drinks. However, many other high-sugar products, including 100 per cent fruit juices, sweetened milk drinks, and ready-to-drink coffees and teas, remain largely untaxed.

While 97 per cent of countries tax energy drinks, WHO observed that this figure has not changed since the last global report in 2023, indicating slow progress in expanding tax coverage.

In Kenya’s 2025 budget, the government introduced a four per cent Sugar Development Levy (SDL) on all sugar, both imported and locally produced, from July last year. The levy was aimed at supporting the sugar sector but also resulted in increased sugar prices. The budget also proposed broader tax measures, including a 16 per cent value-added tax on healthcare and digital services.

Debate has continued in Kenya around the introduction of a specific sugar-sweetened beverage (SSB) tax, with proposals emerging to tax high-sugar drinks such as milkshakes as part of the government’s broader revenue generation efforts.

A separate WHO report shows that at least 167 countries levy taxes on alcoholic beverages, while 12 countries ban alcohol entirely. Despite this, alcohol has become more affordable or remained unchanged in price in most countries since 2022, as taxes have failed to keep pace with inflation and rising incomes.

The report also notes that wine remains untaxed in at least 25 countries, mostly in Europe, despite well-documented health risks associated with alcohol consumption.

Dr Etienne Krug, Director of WHO’s Department of Health Determinants, Promotion and Prevention, said industry profits often come at the expense of public health.

“While industry profits, the public carries the health consequences and society bears the economic costs. More affordable alcohol drives violence, injuries and disease,” Dr Krug said.

WHO found that globally, excise tax shares on alcohol remain low. On sugary drinks, taxes are often weak and poorly targeted, with the median tax accounting for only about two per cent of the retail price of a common sugary soda. In many cases, taxes apply to only a limited range of beverages, leaving large segments of the market untaxed.

Few countries regularly adjust health taxes for inflation, allowing health-harming products to become steadily more affordable over time.

WHO is now calling on countries to raise and redesign health taxes as part of its “three by 35” initiative, which aims to increase the real prices of tobacco, alcohol and sugary drinks by 2035 to reduce consumption and protect public health.

Kenya is a full member of the World Health Organization and actively participates in the World Health Assembly while collaborating with WHO on various health initiatives.

By Wangari Ndirangu